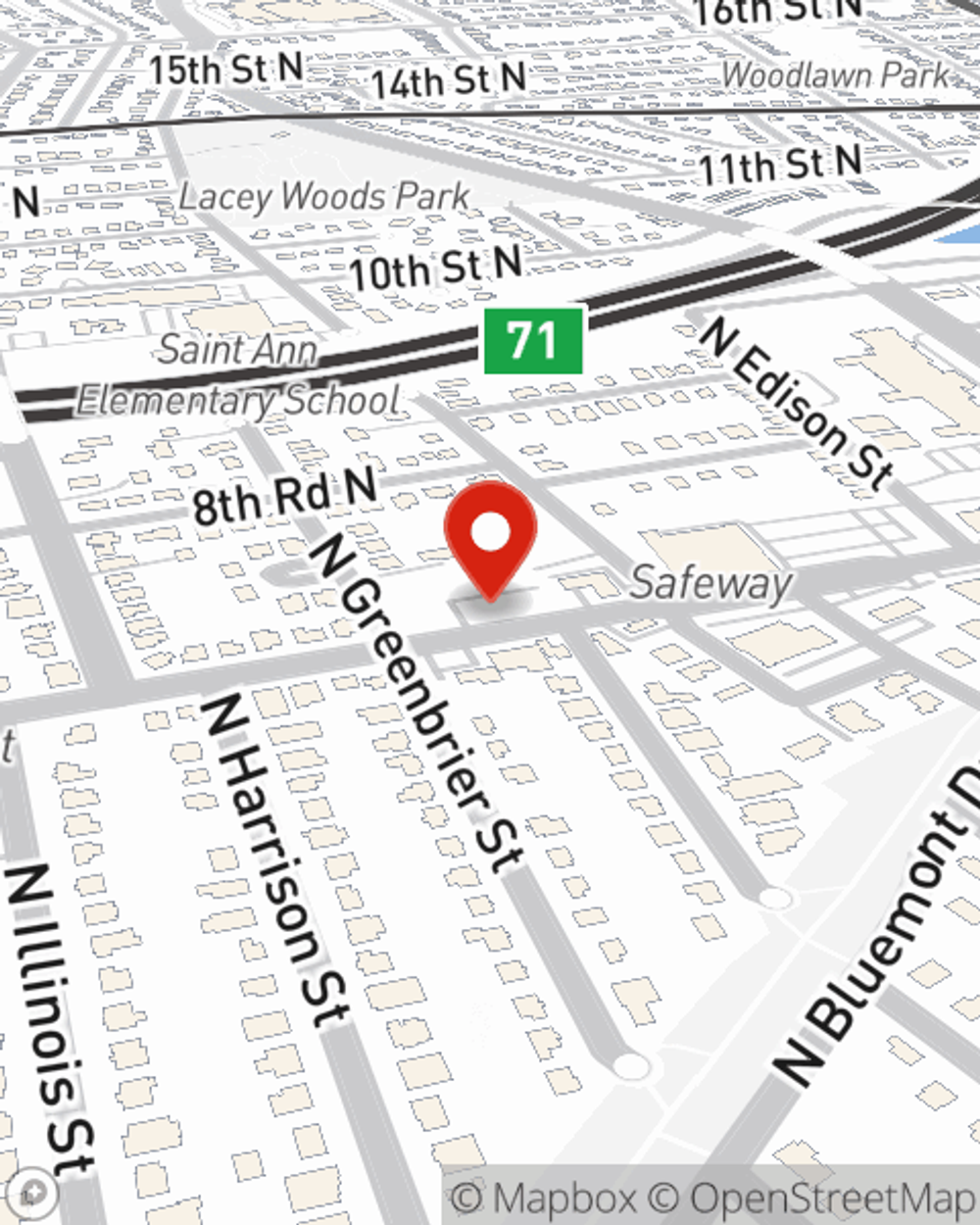

Business Insurance in and around Arlington

One of Arlington’s top choices for small business insurance.

Insure your business, intentionally

- Arlington

- Arlington County

- Fairfax County

- Alexandria

- City of Alexandria

- Fairfax

- Falls Church

- Mclean

- Vienna

- Chantilly

- Tysons

- Merrifield

- Annandale

- Springfield

- Burke

- Reston

- Herndon

- Oakton

- Sterling

- Ashburn

- Leesburg

- Great Falls

- Manassas

- Woodbridge

Business Insurance At A Great Price!

Operating your small business takes hard work, commitment, and great insurance. That's why State Farm offers coverage options like business continuity plans, worker's compensation for your employees, errors and omissions liability, and more!

One of Arlington’s top choices for small business insurance.

Insure your business, intentionally

Cover Your Business Assets

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a yogurt shop, a cosmetic store or an art gallery. Agent Kenya Knight is also a business owner and understands your needs. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Agent Kenya Knight is here to explore your business insurance options with you. Visit with Kenya Knight today!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Kenya Knight

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.